Bringing your International Business to the United States

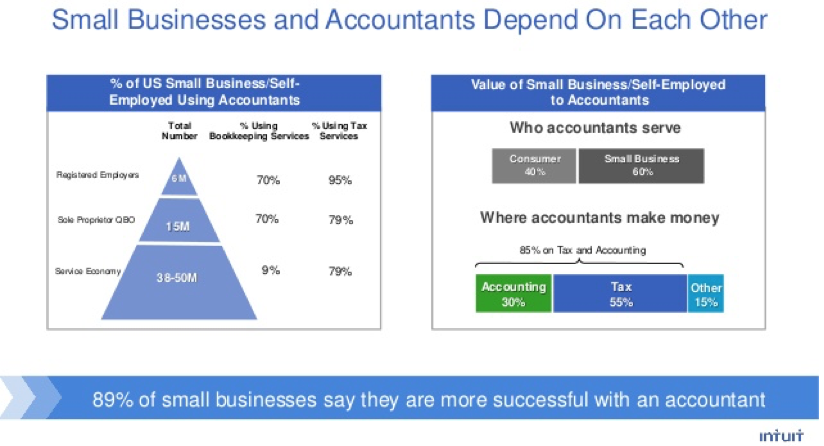

Now that you are ready to bring you International business to the United States, there are many things that you need to consider. First, do you have a business plan? Is it written down? Second, have you hired an accountant? I’m sure you are asking yourself why you need an accountant, but according to statistics, 89% of the small businesses that start their business with an accountant on the payroll have a higher success rate.

As an entrepreneur, you already wear many hats. You are in charge of marketing, maintaining a good relationship with your customers, and if your business is big enough, you also have to take care of the hiring and firing of your employees. Let’s discuss the reasons why a small business should have an accountant at the beginning of their new business.

The Cost of Doing Business

An accountant will help you explore all the needs of your business. For instance, do you need an office space or storefront? There are many costs involved in having an office or storefront. There is the rent or lease, utilities, internet, payroll, insurance, and supplies just to name a few. Cash Flow. If you feel you’re losing control of who owes you money and how much, an accountant can help you get back on track. An accountant will also help you identify what expenses that will be going out and help to make sure you are making enough revenue to keep the business open and putting money into your pocket. Isn’t this why you wanted to start your own business?

Getting the appropriate licensing

Every state has different rules and regulations as far as the appropriate licensing and US tax laws can be very complex. There are sales tax permits and business license needed to have your business open. An accountant will help you to make sure you are on the right track.

Accounting Principles

This may be every business owners nightmare. As a business owner, you will want to stay focused on making money and bringing in new revenue. You will not have the time that is needed to take care of all the bookkeeping, tax planning and preparation, and the financial reporting that will be needed to keep your business running. Oh, and did we mention payroll? Managing the payroll is a difficult task for many business owners because they don’t have the time it takes to know all the rules and regulations for dealing with payroll.

Finding the RIGHT Accountant

This can also be a very daunting chore. There are so many accountants out there, how do you know you have found the right one for your business? This is where we, ReachOut Business Solutions, come in. We will help you find and interview several accountants that have the right expertise for your business. The right accountant will understand your business, the risks and rewards involved in it, and will be available to you year-round to answer your questions. We will make sure they ease your mind and assist with your financial business planning. Click here to contact us now! Don’t delay, tax season is coming and you want to beat the rush!

Don’t forget to like and follow us on Twitter, LinkedIn, and Facebook to keep up with all of our International small business news and updates.